Yesterday I wrote about retirement planning and target date funds here.

Today, I came across the NFO report of one of the largest MFs in India launching its Retirement Fund. I want to share some statistics and facts from the presentation. These are also dated as they have been picked from the census data of 2011. So current scenario may be worse.

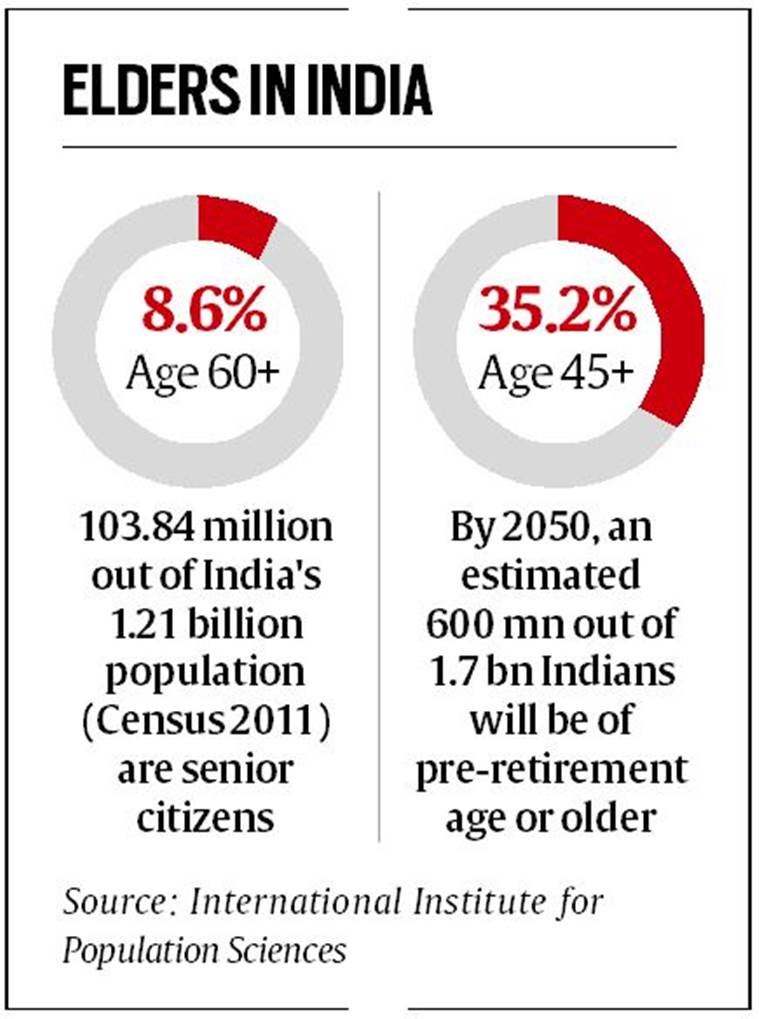

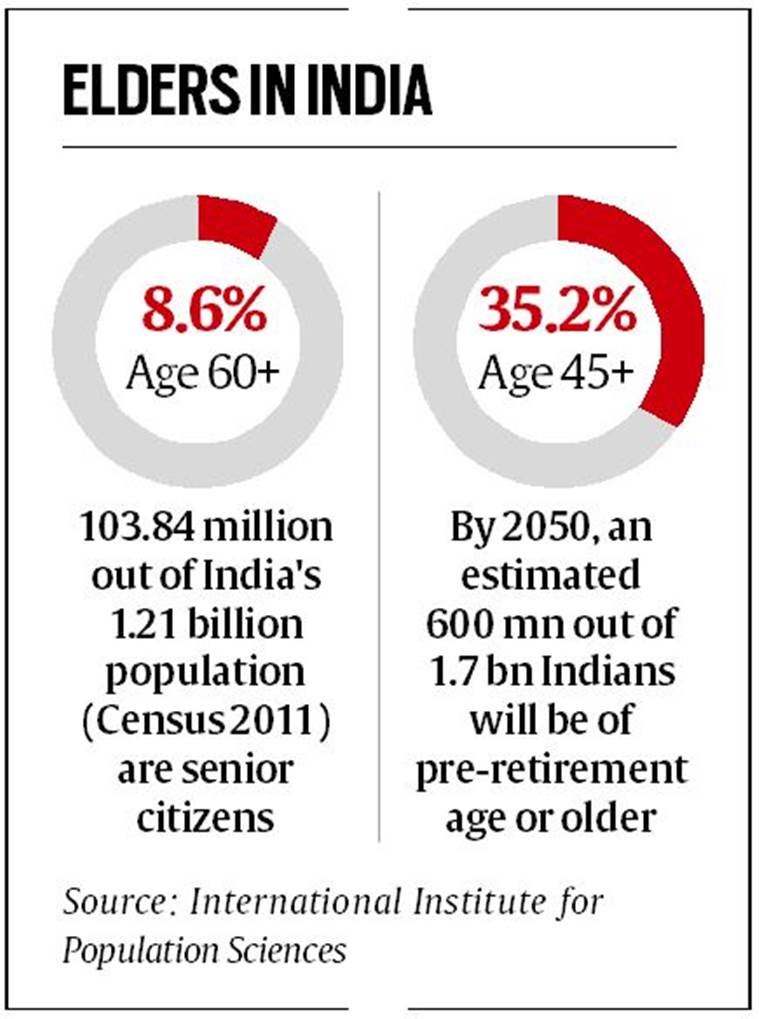

Existing scenario (as per census 2011)

Today, I came across the NFO report of one of the largest MFs in India launching its Retirement Fund. I want to share some statistics and facts from the presentation. These are also dated as they have been picked from the census data of 2011. So current scenario may be worse.

Existing scenario (as per census 2011)

- Only 10% of the 60+ population have income from pension or rent

- 60% of men and around 25% of women over 60+ are still working

- Around 60% of people over the age of 70 are dependents

When do Indians start planning their retirement

Another factoid from an Axa Report of 2011 states that most individuals start planning for their retirement when they are 49 yrs old. How did they calculate the exact age of 49 yrs beats me but you get the drift. Around 10-15 yrs before you are due to retire it dawns about people that they ought to do something.

Millennials and Retirement

Around 15-18% of the current population will retire in 2040-50. This works out to about 23 cr Indians. Huge number.

Shorter working life and higher life expectancy

On account of higher education, people are joining the work force later. This increases their earning capacity for sure but the earning lifespan is lower. A 70 yr old today may have worked for 40 yrs but his son will probably work for 30-35 yrs and his grandson will work for about 25 yrs. And life expectancy of the son is about 10 yrs more than the 70 yr old father and life expectancy of the grandson will probably be 15 yrs more.

So key takeaway is longer life spans, higher earning capacity but lower earning years span. So the importance of planning during those earning years is very important. If you spend and keep upgrading your lifestyle, and dont save enough in inflation beating assets, you are going to have a tough time in your old age.

A recent podcast interview of Subramoney.com by Anupam Gupta titled The Retirement Timebomb is a good one to listen to. He makes some very important points and stresses on the need to start early.

Start small but start early. But if only age could and youth would.

Informative and eye opener

ReplyDeleteThank you

Delete