For the past 8 days I have gone on and on about biases and today I am going to tell you that while it difficult to overcome these biases, it is not impossible to reduce the effect that they have.

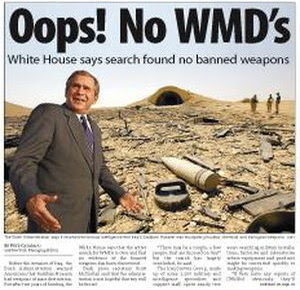

A famous behavioral finance professor carried out this experiment in her class. She asked all the students to write down the last two digits of their cell phone number on a piece of paper. And then she asked them to estimate the number of countries that are there in Africa. Then she collected all the papers and showed that those whose cell phone numbers were higher offered higher estimates. Then she did it again after telling the students that they had been warned. And the same result emerged again.

So what this tells us that just being aware of a bias is not enough to overcome it. We see it all the time in real world too. Cigarette warnings, fat content warnings on junk food, need to exercise et al. We know all of this but find it hard to follow them. Because we are humans. This is harmful to our physical health.

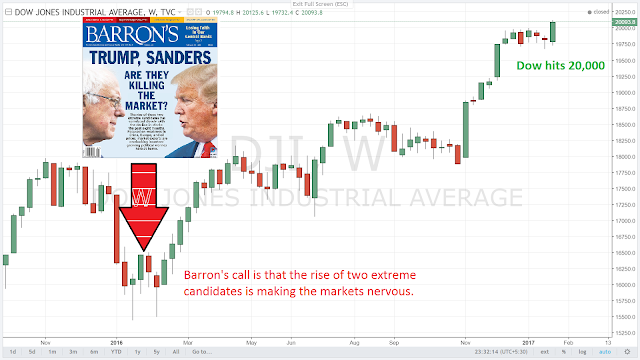

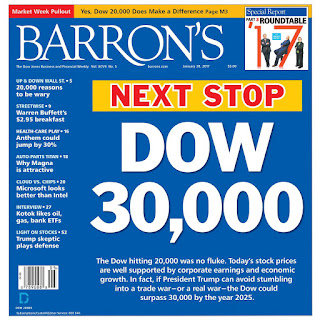

And the behavioural biases are harmful to our financial health but we still continue to be plagued by them.

The one way I have learnt to atleast move one step ahead of just knowing that I have a bias, is to figure out a way to pause between a thought/stimulus and action. Its called being mindful. Mindfulness is said to be a buddhist concept and has been made popular in the west by Jon Kabat-Zinn.

And the way to pause is to check yourself before acting on your thought and the best way to do it ....you guessed it...have a checklist of things to keep in mind before acting.

Mindfulness and use of checklists may perhaps be the single most concept that I can perhaps try and convey to all the readers. Being mindful and using checklists has not made me error free. I still make errors. But I make fewer errors and usually I dont make the same ones again.

Tomorrow more on checklists. Today lets pause and be mindful.

Regards

Anish

QED Capital

A famous behavioral finance professor carried out this experiment in her class. She asked all the students to write down the last two digits of their cell phone number on a piece of paper. And then she asked them to estimate the number of countries that are there in Africa. Then she collected all the papers and showed that those whose cell phone numbers were higher offered higher estimates. Then she did it again after telling the students that they had been warned. And the same result emerged again.

So what this tells us that just being aware of a bias is not enough to overcome it. We see it all the time in real world too. Cigarette warnings, fat content warnings on junk food, need to exercise et al. We know all of this but find it hard to follow them. Because we are humans. This is harmful to our physical health.

And the behavioural biases are harmful to our financial health but we still continue to be plagued by them.

The one way I have learnt to atleast move one step ahead of just knowing that I have a bias, is to figure out a way to pause between a thought/stimulus and action. Its called being mindful. Mindfulness is said to be a buddhist concept and has been made popular in the west by Jon Kabat-Zinn.

And the way to pause is to check yourself before acting on your thought and the best way to do it ....you guessed it...have a checklist of things to keep in mind before acting.

Mindfulness and use of checklists may perhaps be the single most concept that I can perhaps try and convey to all the readers. Being mindful and using checklists has not made me error free. I still make errors. But I make fewer errors and usually I dont make the same ones again.

Tomorrow more on checklists. Today lets pause and be mindful.

Regards

Anish

QED Capital