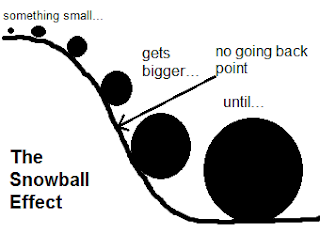

Snowball your Savings

“Stocks are the things to own over time.

Productivity will increase and stocks will increase with it. There are only a

few things you can do wrong. One is to buy or sell at the wrong time. Paying

high fees is the other way to get killed. The best way to avoid both of these

is to buy a low-cost index fund, and buy it over time. Be greedy when others

are fearful, and fearful when others are greedy, but don’t think you can

outsmart the market. “If a cross-section of American industry is going to do

well over time, then why try to pick the little beauties and think you can do

better? Very few people should be active investors.” - Warren E Buffett

Each sentence in the paragraph above is an

investment tenet by itself. Lets break it down.

1.

Equities are the things to own

over time. Productivity will increase and equities will increase with it. There

are only a few things you can do wrong. One is to buy or sell at the wrong

time.

2.

Paying high fees is the other way

to get killed. The best way to avoid both of these is to buy a low-cost index

fund, and buy it over time.

3.

Be greedy when others are fearful,

and fearful when others are greedy, but don’t think you can outsmart the

market.

4.

If a cross-section of American

industry is going to do well over time, then why try to pick the little

beauties and think you can do better? Very few people should be active

investors

In simple terms, a snowball effect is a situation that increases in size or importance at a faster and faster rate.

Simply put:

- Very few people have the time and inclination to be full investors. And this is not something to dabble in over the weekend. Start accumulating low cost index funds early in your life and keep snowballing it regularly.

- Paying high fees means giving away snow from your snowball. Be careful.

- The crowds get fearful at bottoms and at tops. But no one, not even Buffett or Soros or Rakesh or your local fund manager can ring a bell at the PRECISE top or bottom. But you can approximately time the market via following some simple rules. It is boring and its slow. But you are not doing this for excitement or entertainment.

- Don’t be too cute and think that you can outsmart the market consistently over a long periods of time. If most retail investors were to even get market returns over a long time, they would end up far richer than trying to be extra smart.

The market is like a haystack and

everyone is looking for a golden needle in it. But if you could get access to a

gold haystack then would you really waste time looking for a golden needle.

There are lot of other things in life to focus on. Pick your share of gold hay

and move on.

To Be Continued.....